We respect the unique M&A market insights that Sutton Place Strategies, an affiliate of Bain & Company, creates from its business development work with PE firms.

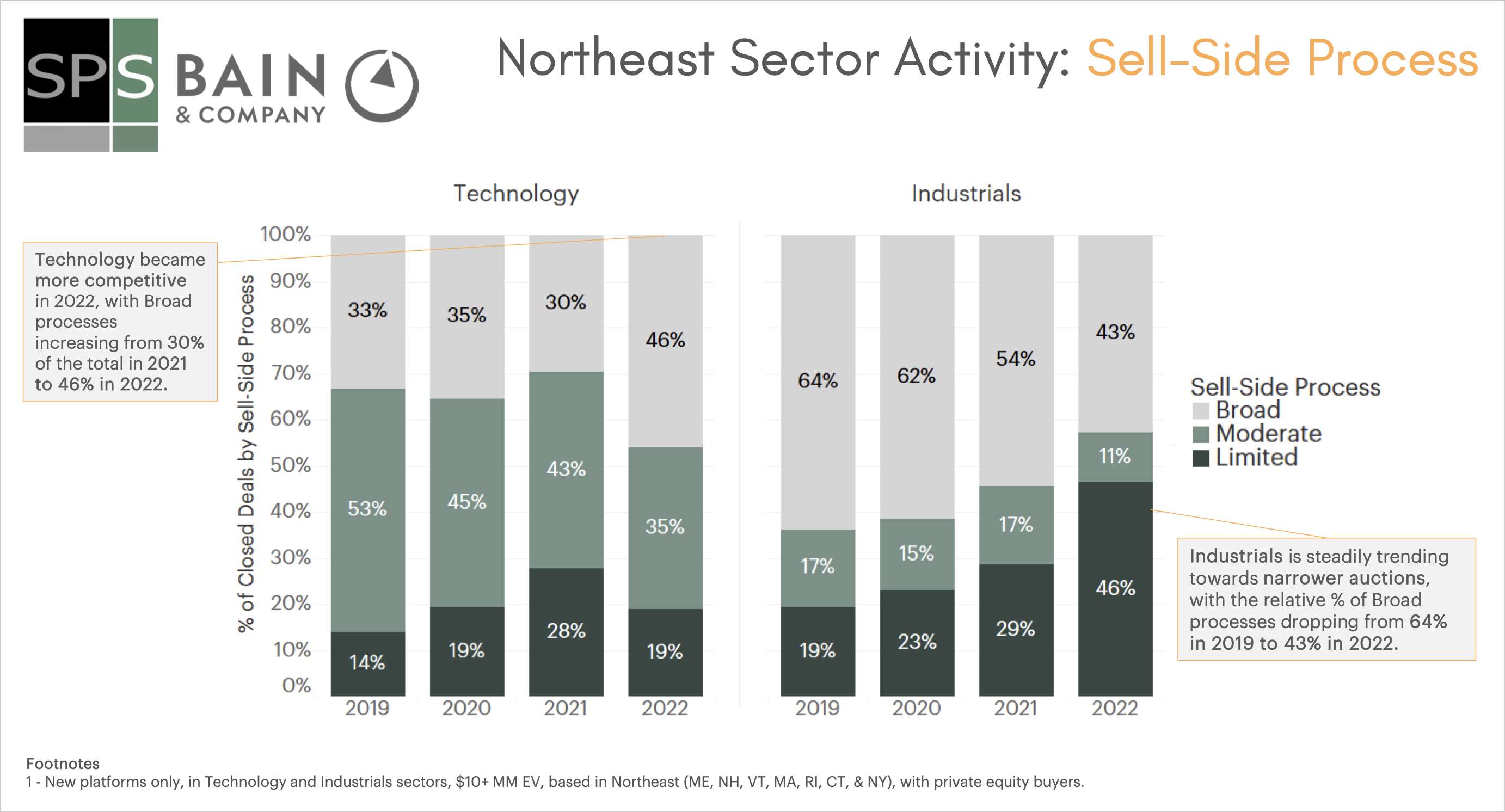

SPS Founder and CEO Nadim Malik gave a presentation at ACG Boston’s M&A Outlook forum in October 2022 that we found particularly illuminating. We were most interested in SPS’s proprietary insight into “broad,” “moderate” and “limited” deal processes used in M&A deal activity in the Northeast U.S. These terms relate to how selling business owners find buyers — either approaching the whole market, or choosing a large or small group of parties to work with.

Why are limited processes growing so much among industrial companies? We think it’s because well-run roll-up companies are getting very good at proprietary deal sourcing, with disciplined use of CRMs and corporate development processes embedded in the portfolio companies instead of being staffed only at the PE fund level.

Our firm, which helps business owners respond to incoming offers (and therefore, rarely organizes broad M&A processes), is seeing the result of this work in the offers that clients bring to us.

In industries where there are fewer established roll-up platforms or a wider variety of reasons for strategic acquirers to consider an acquisition — as in tech — it makes sense to us that limited M&A processes are less prevalent. In our work with VC-backed companies that haven’t grown as expected but still need to create exits for their investors, we typically approach as many companies as possible with a potential need for our client’s business as part of their product roadmap.

To see Nadim Malik’s full presentation, click here.